The World Bank says the mandatory sale of export proceeds re-introduced by the Reserve Bank of Malawi (RBM) in August 2021 should be phased out as soon as macro-economic situation improves.

RBM re-introduced the mandatory sale of export proceeds in a bid to ensure foreign exchange availability in the country.

Under the provision, all exporters are required to sell a minimum of 30 percent of their export proceeds to authorised dealer banks (ADBs) while retaining 70 percent of the proceeds in their foreign currency denominated accounts (FCDAs).

In a paper titled ‘What can Malawi do to bolster its reserves?’, the multilateral bank said there are several policy options for increasing reserves, including greater exchange rate flexibility, developing the foreign exchange interbank market and strengthening the RBM’s reserve management.

Reads the paper in part: “The mis-alignment of the real exchange rate can reduce exports and creates uncertainty for businesses. In addition, greater flexibility in the exchange rate is needed to enable convertibility and increase liquidity in the market.

“Developing the foreign exchange interbank allows for transparent currency exchange, facilitates price discovery and helps current account adjustments. The mandatory retention of export proceeds of 30 percent enforced by the RBM since August 2021 should be phased out as soon as macroeconomic circumstances recover.”

In strengthening the RBM’s reserve management, the World Bank said key priorities include establishing a reserve management strategy, establishing a registry to ensure consolidating records of all liabilities and contracted facilities, timely reporting and enhancing transparency and accountability.

In 1994, RBM introduced an export incentive scheme that allows exporters to retain export proceeds in their FCDAs.

The scheme started with a retention/conversion ratio of 10/90 and has progressively been adjusted downwards until it was abolished in March 2015.

Since the abolishment of the retention/conversion ratio, exporters were allowed to retain 100 percent of export proceeds in their FCDA.

However, this alone failed to sufficiently support the foreign exchange supply to eradicate imbalances in the interbank market.

Consequently, RBM devalued the kwacha by 25 percent in May this year to improve external sector competitiveness and build up official reserves, align the exchange rate with market fundamentals, as well as improve the circulation of foreign exchange in the market.

Speaking in a recent interview, RBM Governor Wilson Banda indicated that the central bank is indeed facing pressure to manage foreign exchange in the country as supply and demand imbalances continue to escalate.

He, however, was quick to mention that the government is also looking into other long term measures to boost exports and the country’s forex position

Money market analyst Cosmas Chigwe said despite the devaluation of the kwacha, the central bank continues to maintain overvalued official exchange rates, while unable to ensure that supply of foreign exchange meets legitimate demand transactions at that price.

According to the data, as at November 17, official telegraph transfer sell was at around K1 030 while cash sells was at around K1 450 against the dollar.

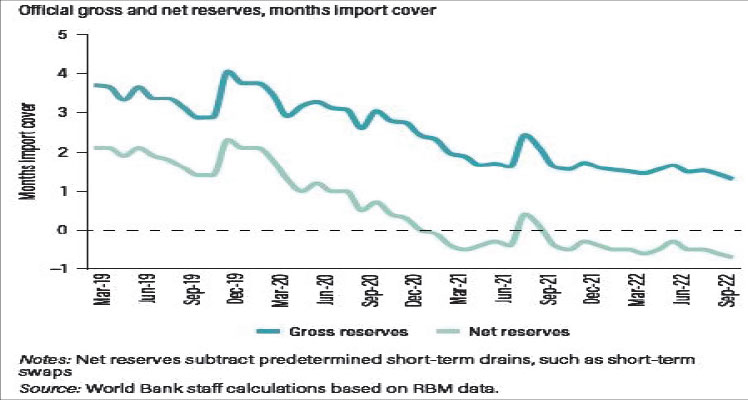

Meanwhile, gross reserves decreased by more than half, from $847 million in December 2019 and one-third over the year from $605 million in August 2021 to $326 million in October 2022, or around 1.3 months of import cover.

This is much lower than the recommended adequacy level of 3.9 months of import cover for a credit-constrained economy, according to International Monetary Fund statistics.

In Malawi, sources of foreign reserves include earnings from exports, remittances, foreign direct investment and foreign assistances.

The post World bank speaks on forex measure appeared first on The Nation Online.

Moni Malawi

Moni Malawi