Malawi attracted $765 million (about K775.78 billion) investment pledges in the first five months of the 2022/23 financial year (April and August), figures from Malawi Investment and Trade Centre (Mitc) show.

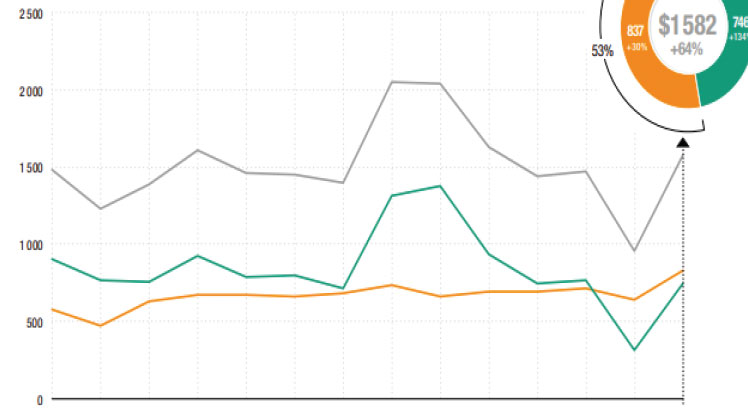

The figures registered in investment pledges are higher than those recorded within the same period in the 2021/2022 financial year, which was $106 million (about K107.49 billion)

The Mitc figures show that investment pledges are from 12 companies from countries that include UK, India, Mauritius, Poland, Germany and Canada, whose investment projects once operational could generate at least 3654 jobs.

In terms of specific sectors, the construction sector recorded the highest number of interest from investors, claiming 55 percent of the pledges followed by energy claiming 16 percent agriculture/agro-processing sectors at 16 percent, and the manufacturing sector at three percent.

In a written response, Mitc public relations manager Deliby Chimbalu said Mitc continues to woo investments through, among others, the one-stop service centre which is helping the centre to streamline the investment registration process in Malawi.

“Through this set-up we have managed to assist a number of investors who had issues in setting up their investment in the country.

“For instance, the issue of land has been a challenge but through our lands specialist in the One- Stop Service Centre, we are now able to provide support to both domestic and foreign investors in this area,” she said.

According to Chimbalu, besides handling issues of land for investment, investors can also use this set-up to get their business permits as well as apply for tax incentives for their various investment projects.

Mitc data further indicated that through the investment facilitation’s firm land desk in the One-Stop Service Centre, Mitc facilitated land identification, acquisition and advisory services to about 13 investors who are operating in the energy sector, manufacturing, agriculture and tourism sectors.

Economic statistician Alick Nyasulu, in an interview recently, observed that issues of investments will always hinge on a favourable climate.

These include a viable financial sector with limited controls, non-discretionary tax policies, the ease to repatriate profits, cost and reliability of utilities, an efficient legal system and government bureaucracy, among others.

He said these issues have been wanting for a while, adding that Malawi still remains relatively unattractive to regional peers.

“We can only hope that these new investments both domestic and FDI are export-oriented as this is a key driver of growth,” said Nyasulu.

In Malawi, most FDI has been directed to the energy sector followed by manufacturing and mining sectors, according to Mitc.

Meanwhile, available figures show that Malawi recovered in the attraction of Foreign Direct Investment (FDI) in 2021, attracting about $50 million (K50.7 billion) about 11 percent higher than the previous year’s level of $45 million (K45.6 billion).

The United Nations Conference on Trade and Development (Unctad) 2022 World Investment Report released mid this year however shows that at $50 million Malawi attracted less than one percent of the $1.6 trillion globally.

Despite the strong global growth in FDIs, the report shows that investment flows to Africa at $83 billion (K85.66 trillion) in 2021, double the amount reported in 2020, accounted for only 5.2 percent of global FDI, up from 4.1 percent in 2020.

The report indicates that Malawi lagged behind its neighbouring Mozambique which attracted $5.1 billion, Zimbabwe at $166 million and South Africa $40.8 billion but trailed Zambia whose FDI inflows were negative at -$457 million.

The post Five-month investment pledges jump to k775.78bn appeared first on The Nation Online.

Moni Malawi

Moni Malawi