Data from the Reserve Bank of Malawi (RBM) shows that commercial banks extended K2.5 trillion credit to the Malawi Government during the first quarter (Q1) of this year.

Government dominance in borrowing from commercial banks has come under spotlight with analysts arguing the development is detrimental to meaningful investment.

The Q1 Financial Economic Review Report issued by RBM also indicates that commercial banks’ holding of Treasury notes and Treasury bills increased by K128 billion and K120.2 billion to K1.49 trillion and K504.2 billion, respectively.

The data, however, shows that credit to the statutory bodies and the private sector, on the other hand, declined by K58.5 billion and K17.3 billion, respectively.

Financial market analysts have since indicated that heavy government borrowing on the domestic market is crowding out the private sector which needs to be tamed by the RBM.

Speaking in an interview on Tuesday, financial services strategist Misheck Esau observed that the huge government borrowing is coming at the expense of the private sector which is now struggling to access loans.

He said: “The central bank must take immediate action to promote production by looking at the borrowing pattern of banks to government versus private sector.

“The RBM has power to force banks to meet minimum lending ratios using its powers in Section 23 of the Banking Act.”

Esau said banks are now mostly lending to the government at the expense of investment in productive sectors yet foreign exchange is generated by the private sector.

He said small and medium enterprises lending should also be given a better risk weight in bank capital computation under Basel rules, adding that this will spur production unlike lending only to consuming government and its agencies, which instead creates heavy demand for forex.

Malawi University of Business and Applied Sciences associate professor of economics Betchani Tchereni said while commercial banks are smiling as they know they will make huge profits, the real sector is the major sufferer.

He said: “When government is borrowing a lot like it is now, commercial banks are assured of a ready market, but as this is happening, the private sector is left out.

“However , for industrialisation to take off, one has to rely on external funding yet banks have deposits lying idle ready to extend the same to the government.”

Economist Thomson Kumwenda also observed in a paper titled ‘Government Treasury bonds, a double-edged sword for holders’ published, last week said high government borrowing from banks could be disastrous.

He said: “Financial institutions make easy profits from holding presumably low risk sovereign debt, but at the same time sovereign debt that is in distress can sink entities and reverse the previous capital augmenting gains.”

Chamber for Small and Medium Enterprises executive secretary James Chiutsi said in an interview government’s huge domestic borrowing is compelling banks to consider the private sector as less lucrative.

“For years, financial institutions have looked at the SMEs sector as high risk and have perpetually avoided them,” he said.

In an earlier interview, Malawi Confederation of Chambers of Commerce and Industry president Lekani Katandula indicated that banks are now attracted to the government at fairly attractive interest rates as domestic debt grows at the expense of more risky lending to the private sector.

He said: “One can only hope that the government borrowing will be directed to productive investments and that the government will soon contain its borrowing to restore the attractiveness of private sector lending for the banks.”

FDH Bank plc managing director Noel Mkulichi in an earlier interview also admitted that banks are borrowing government, but was quick to mention that this is not stopping the banks from borrowing the private sector.

He said: Government has got the appetite at this point because it has a deficit which it needs to cover.

“This, however, does not stop us from lending other avenues because it is the duty to do intermediation which creates growth.”

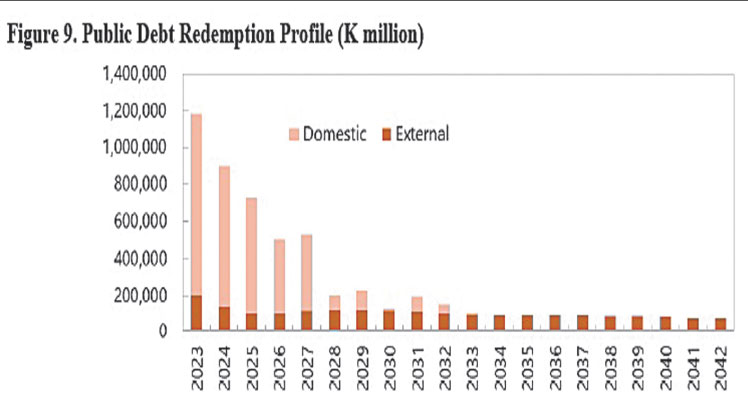

Currently, Malawi’s public debt stands at K7.9 trillion as at December 2022.

The post Banks extend k2.5TN credit to govt in Q1 first appeared on The Nation Online.

Moni Malawi

Moni Malawi