Market watchers and local businesses say despite the weakening of the rand presenting an opportunity for local businesses, the real impact would depend on various actors, including potential inflation in South Africa.The rand fell against the dollar and other currencies last week on investor concerns over the worst power cuts. Another concern was the United States of America allegation that a Russian ship had picked up weapons in that country last December.

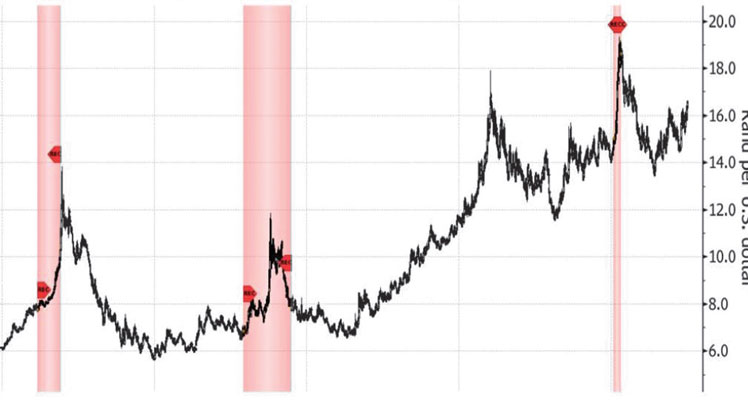

South Africa is Malawi’s and the Southern African region’s largest trading partner and Reserve Bank of Malawi (RBM) and Authorised Dealer Banks (ADBs) figures show that in a space of one week, the rand dropped from K58 to about K55 as of Friday.

In a written response on Saturday, Bridgepath Capital Limited chief executive officer Emmanuel Chokani said while a depreciation of the rand would likely mean an appreciation of the kwacha against the rand, the real impact would depend on how the kwacha is performing against other currencies, especially the dollar. “With the depreciation of the rand, Malawi’s imports from South Africa would effectively become cheaper in kwacha terms, potentially improving the country’s balance of trade.

But Malawi’s exports to South Africa would become more expensive for South Africans, potentially leading to a decrease in demand for Malawian goods, which could negatively impact Malawi’s export revenues and balance of trade,” he said. Chokani said in the medium-term, the effects could become more complex, adding that as South African companies adjust their prices to compensate for the weaker rand,

it could reduce or eliminate the initial advantage gained by Malawian importers. “If inflation in South Africa causes prices to rise, which is a likely scenario when a currency depreciates, then the cost of imports to Malawi might not decrease.” Financial services strategist Misheck Esau said in an interview yesterday that there might be little impact as the country’s economy is too weak to take advantage of the weak rand.He said: “A weak rand will actually weaken our balance of payments position further because imports from South Africa may stay strong or increase.

“This is because we do not have foreign exchange.” But Chamber for Small and Medium Enterprises executive secretary James Chiutsi said a weak rand presents an opportunity for local businesses to run at a lower cost.South Africa remains Malawi’s biggest trading partner, accounting for 66 percent of Malawi’s total trade with the Southern African Development Community region.

In the past three years to 2021, imports from South Africa have increased from K35 billion in 2019 to K441 billion in 2021, according to the National Statistical Office.

The post Mixed fortunes on SA rand fall first appeared on The Nation Online.

Moni Malawi

Moni Malawi