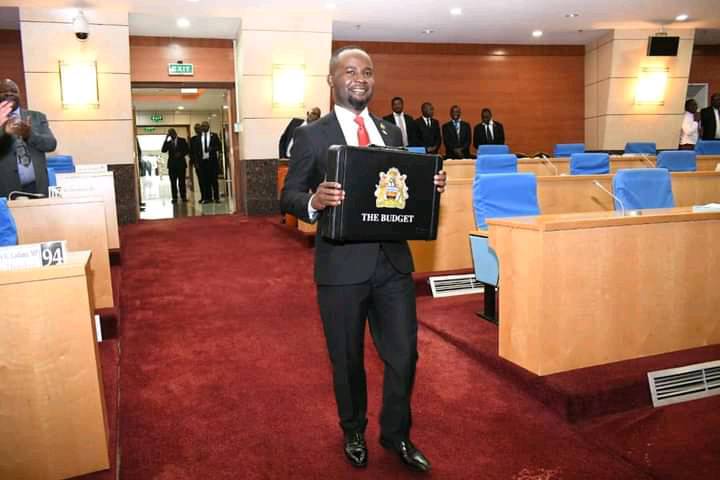

Finance Minister Sosten Gwengwe: Under fire

Representatives of banks and shareholders say they are shocked by Tuesday’s decision by Finance Minister Sosten Gwengwe to impose a selective income tax on banks that make profits of MWK10 billion or more.

The representatives said they are discussing possible legal redress over the decision which comes as Parliament plans to approve the 2023/24 budget on Friday.

Parliament is currently deliberating the 2023/24 budget in Lilongwe.

“What is the legality of this in the context of the Malawi Taxation Act? While we appreciate the need to raise funds for recovery and relief after Cyclone Freddy, the Finance Minister’s decision appears selective and illegal. Why is he only targeting banks leaving out other sectors like telecoms, construction, and agriculture that make similar levels of profit, if not more?” wondered one senior banker who did not want to be named.

Another member of the BAM said profitable institutions like banks and others are accountable to their shareholders and are charged with the responsibility of protecting shareholder interests.

“Such selective taxes will hurt the goose that lays the golden egg, and ultimately derail the economy which is already in doldrums. The government needs banks to be strong and resilient for it to navigate the financial markets easily when accessing credit to balance its budgets. It must not be too greedy, just because banks and other institutions are working hard to keep the economy balanced, and working,” she said.

In his winding up statement, the finance minister ordered amendments to tax and non-tax revenue policies aiming to raise funds in the wake of Cyclone Freddy.

“The government is introducing an additional income tax of 10% for bank profits above MWK10 billion. Thus if a bank makes profits of up to MWK10 billion, the standard corporate income tax rate of 30 percent will be applicable. However, all profits above MWK10 billion will be treated as excess profits and taxed at 40 percent. This is a temporary tax measure aimed at raising resources to assist in rebuilding the Cyclone Freddy affected areas,” said Gwengwe.

Concerned financial institutions wondered why government was being retrogressive in its taxation policy as previous regimes had scrapped off the 40 percent tax bracket on individual income tax on the basis that it was contrary to the principle of tax equality.

Coincidentally, while Gwengwe wants to impose additional taxes on banks for Cyclone Freddy recovery, local banks were the first to respond to the disaster by donating a combined total of MWK 500 million for relief operations. The banks said they were ready to pump in more after thorough assessments of Cyclone damage by government.

The post BANKS ACCUSE GWENGWE OF TAX-PINCHING…Seek clarity on selective tax on bank profit appeared first on Malawi Voice.

Moni Malawi

Moni Malawi