Individual and household loans continue to rise and account for the largest stock of outstanding private sector credit at 32.7 percent, data from the Reserve Bank of Malawi (RBM)shows.

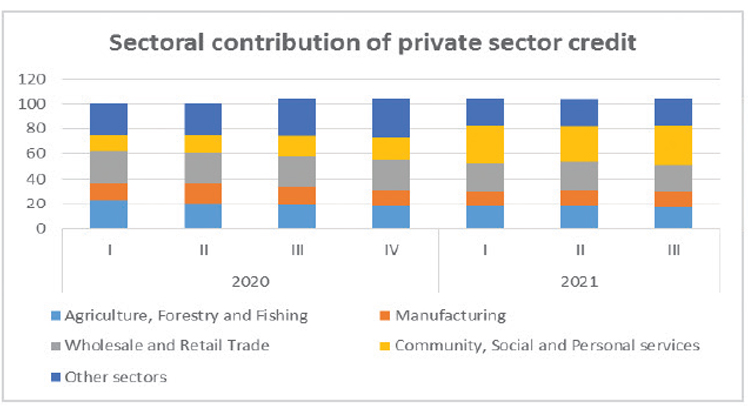

RBM February Economic Review Report shows that the community, social and personal services sector held the largest share of outstanding private sector credit at 32.7 percent.

This is coming at a time when the country’s household consumption expenditure as a percent of the gross domestic product (GDP), the private consumption for households on various goods and services, is currently at about 79.21 percent, according to World Bank figures.

On the other hand, the country fares poorly in terms of savings as figures show that savings are minimal and

compare unfavourably to other African countries whose average is at around 12 percent.

The figures show that the savings rate has remained stagnant at a paltry 4.4 percent for the past four years.

In an interview yesterday, Catholic University economics lecturer, Hopkins Kawaye said it is dangerous for households to be borrowing heavily when the cost of living is increasing.

He said the debtors, who will eventually have to repay the loans, will certainly face a hard time repaying the loans as the outlook for interest rates is not favourable.

Kawaye said: “While we appreciate that people are burdened, the solution should not be borrowing from banks to maintain a standard of living, rather be cautious by reducing their expenditure at household level.

“If anything, if people are to borrow, let these loans be taken for investment in any investment avenues that can give them returns and not purely for consumption.”

Malawi University of Business and Applied Sciences economics professor Betchani Tchereni observed that the data shows that the country remains a highly consuming and importing nation.

He said: “Most of these personal loans are used to acquire conductive goods such as electronics, motor vehicles and sometimes for holidays.

“This is a situation which on the other hand is contributing to the worsening depreciation of the kwacha. An ideal situation is where we have more investment loans than consumption loans.”

In his explanation on the rising personal loans, Consumers Association of Malawi executive director John Kapito said consumers are struggling to make ends meet, as such, are resorting to borrowing from banks and default as economic activity has not yet picked up to desired levels.

“These figures are a reflection of the current economic challenges due to the high cost of living and in a country where people do not have social safety. This clearly speaks on the need for government to come up with mitigating factors to caution people,” he said.

Meanwhile, agriculture, the main driver and sector that contributes over 30 percent to the country’s gross domestic product, wires in over 80 percent of foreign exchange and employs about 90 percent of the workforce, claimed 15.4 percent of credit.

On the other hand, manufacturing, a sector that creates employment and builds forward and backward linkages, claimed only 12.2 percent, according to the data

The post Households dominate loans in credit basket appeared first on The Nation Online.

Moni Malawi

Moni Malawi