Treasury plans to borrow K501.77 billion from the domestic market between now and June, a move economists argue will affect the country’s macroeconomic environment.

The economists said this in interviews in reaction to a debt issuance calendar issued by the Reserve Bank of Malawi (RBM) which indicates that Treasury plans to borrow K208.33 billion through Treasury Bills and K293.44 billion through Treasury notes.

The figure is about 76 percent of the K654 billion that the government plans to borrow from the domestic market in the 2022/23 financial year, which runs till March 31 next year.

In an interview yesterday, Malawi University of Business and Applied Sciences economics professor Betchani Tchereni observed that while commercial banks are smiling as they know they are going to make huge profits, the real sector will be the major sufferer.

He said: “When government is borrowing a lot like it is doing now, commercial banks are assured of a ready market, but meanwhile as this is happening, there will not be enough funds to be advised towards industrialisation or indeed private sector.

“In turn, our private sector will not have much, thereby thwarting the efforts of the country’s development agenda. Such deeper borrowing in an environment where we have inflationary pressures and depreciation of the currency, interest rates are likely to be raised and inflation is going to continue to rise.”

On his part, market and investment analyst Cosmas Chigwe observed that the lack of market depth is an issue in Malawi, stating that in the absence of investment avenues, investors have no choice but to borrow from the government even at such costs.

He said: “The government paper remains an attractive instrument for investors who usually have the money and find the interest attractive, thus, going on to lend the government. This is a balance we have to manage or government debt will continue to be unsustainable.”

In recent times, domestic borrowing has continued to expand through Treasury notes as the government has been implementing a deliberate strategy to lengthen the maturity profile of domestic debt.

The increasing domestic borrowing has since contributed to a substantial increase in government borrowing.

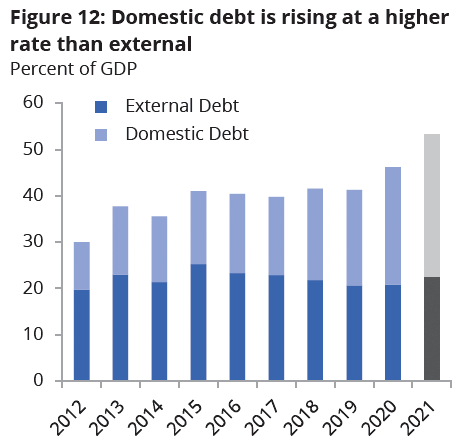

Treasury figures show that as at December 31 2021, total public debt (TPD) stock stood at K5.8 trillion, or 56.8 percent of rebased gross domestci debt (GDP), as compared to a stock of K5.45 trillion, or 58.8 percent of GDP, in June 2021.

This equates to an increase of 7.1 percent in absolute terms, but a decrease of two percentage points as a ratio of GDP.

The end December 2021 TPD stock comprised K2.8 trillion (27.3 percent of GDP) external debt and K3.04 trillion (29.5 percent of GDP) domestic debt.

Of the total domestic debt stock of K3.04 trillion, K2.49 trillion were Treasury notes, K341.0 billion were Holdings of Treasury bills. K133 billion were promissory notes and K73.9 billion were ways and means advances from the Reserve Bank of Malawi with commercial banks holding of K1.41trillion followed by the Reserve Bank of Malawi with holdings of K865.42 billion.

Meanwhile, Minister of Finance and Economic Affairs Sosten Gwengwe is on record as having said that government is looking at a domestic revenue mobilisation strategy to mobilise more resources to help minimise borrowing by Treasury both from local and external sources.

The Minister said government wants to reduce the financing gap by a percentage point every fiscal year until the gap closes in the medium-term by living within our means through cuts, expenditure controls, and efficiency in public service delivery.

In the 2022/23 National Budget, the overall fiscal balance is estimated at about K884 billion, representing is 7.7 percent of GDP.

The post Treasury borrowing plan raises eyebrows appeared first on The Nation Online.

Moni Malawi

Moni Malawi